The Savings Accounts You Need To Know About

Why You Should Open A Savings Account

If your financial goals are largely short-term in nature – think holidays, house renovations or a solid rainy-day fund –it makes sense to build up a cash pot with the help of a decent savings account. As long as you make regular deposits, you’ll find you can build a reasonable sum without even trying. True, savings accounts offer historically lower returns than investing, but those returns are also steadier – which could be a more prudent approach while we’re in a period of market volatility. Plus, with the Moneybox app, you can set up a regular weekly deposit, a monthly payday boost or make one-off deposits whenever you like. Even better, you can also use the app to save your spare change from everyday purchases, rounding up the total bill to put the pennies away for later.

Why Now Is A Good Time To Save

The cost-of-living crisis means now is the ideal time to open a savings account and protect yourself against unforeseen expenses. That’s where Moneybox can help. Its range of easy-to-open and easy-to-use savings accounts are designed for everyone at every income level, and some come with higher levels of interest, if that’s a priority. You can also use Moneybox’s inflation calculator to find out how much your expenses might go up this year, and therefore understand better which one of its savings accounts might work best for you. Inflation is a complicated issue, and one worth reading up on. To make your cash savings grow over time, the return you’re getting from interest needs to be higher than the rate of inflation. If it’s not, you’re losing money in real terms.

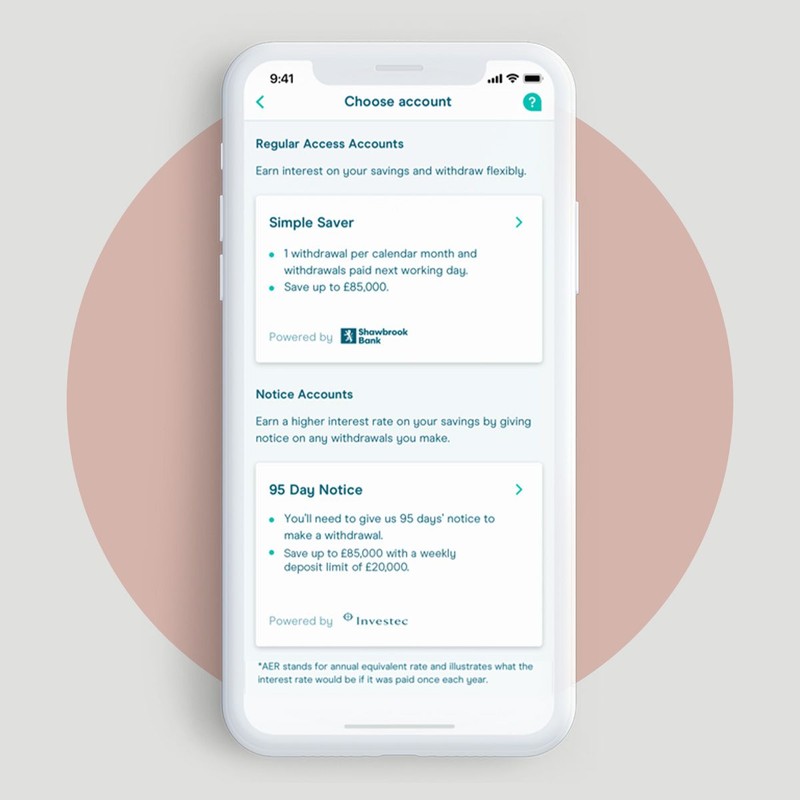

The Different Moneybox Savings Accounts On Offer…

AER variable: 0.47%

Withdrawals: 1 per month, no notice required

Fees/charges: None

Minimum & maximum deposit: £1 (up to £85,000)

Need-to-knows: This savings account is powered by Moneybox’s partner Shawbrook Bank, an institution covered by the Financial Services Compensation Scheme (FSCS) – which means your savings are protected up to £85,000. Withdrawals are limited to one per calendar month, but they’ll be paid into your bank account on the next working day. Interest is calculated daily and paid into your account each month – and you’ll be notified of any change in the interest rate.

For more information click here

AER Variable: 0.71%

Withdrawals: Require 32 days’ notice

Fees/charges: None

Minimum & maximum deposit: £1 (up to £85,000)

Need-to-knows: This account is powered by Investec bank and also covered by the FSCS, so your savings are protected up to £85,000. The only thing to note is the 32-day notice period for this account: when you request a withdrawal, Moneybox will receive the money from Investec 32 days later, then transfer it to your nominated bank account. Meanwhile, interest is calculated daily and paid monthly, but you’ll be kept up to date with any interest rate changes.

For more information click here

AER variable: 0.80%

Withdrawals: Require 120 days’ notice

Fees/charges: None

Minimum & maximum deposit: £1 (up to £85,000)

Need-to-knows: Powered by Shawbrook Bank, your savings here are protected up to £85,000. In exchange for a 120-day notice period, you’ll be able to earn a higher interest rate for keeping your money stored away for longer. Interest is calculated daily and paid into your account each month, and just like the others, you’ll be notified of any changes in the rate.

For more information click here

Visit Moneybox.com and download the app here

*DISCLAIMER: Anything written by SheerLuxe is not intended to constitute financial advice. Any views expressed in this article reflect the opinions of the individuals, not the company. Always consult with an independent financial advisor or expert before making an investment or personal finance decisions.

DISCLAIMER: We endeavour to always credit the correct original source of every image we use. If you think a credit may be incorrect, please contact us at info@sheerluxe.com.