The Membership With Lifestyle, Travel & Fitness Rewards

What Is Revolut?

If you’re not already familiar, Revolut launched its app in the UK back in 2015, offering money transfer and exchange. Today, 30 million customers around the world use dozens of Revolut’s innovative products to make more than 400 million transactions a month across both personal and business accounts. Its mission? To help customers improve their financial health, give them more control, and connect people all around the world.

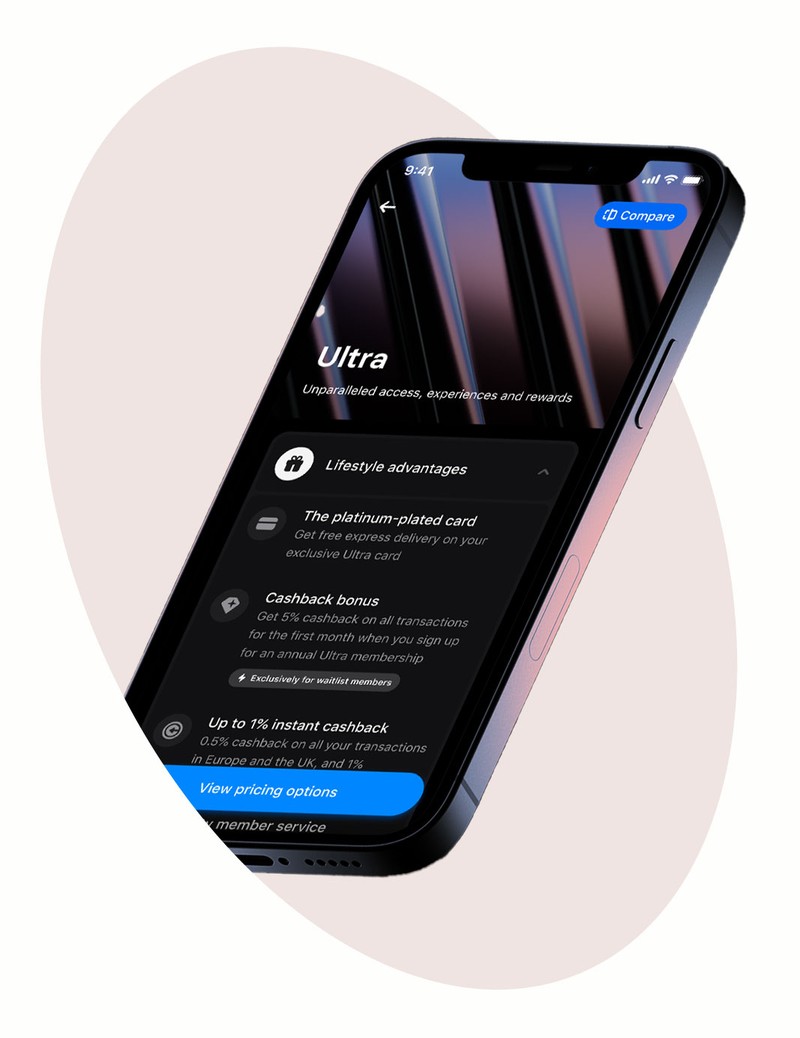

What’s Ultra?

Revolut Ultra is a plan like no other. Bringing you unrivalled experiences, unparalleled access and Revolut’s most generous limits yet, Ultra offers more than £4,000* in annual benefits – and that’s not all. If you’re on the waitlist, Revolut will welcome you to the annual plan with 5% cashback on purchases in your first month (capped at the monthly plan price, T&Cs apply). Not on the waitlist? You’ll still earn 0.1% cashback in Europe and 1% outside from day one. Meanwhile, Ultra platinum-plated cards will be exclusively issued by Mastercard, and the plan will be priced at £540 per year – and remember, this is a debit card, so there’s no damage to your credit score and no eye-watering APR rates.

Who Is It For?

The Ultra plan is perfect for you if you travel frequently and like the sound of trip cancellation cover and lounge benefits, or if you’re planning to make use of your investment opportunities. Think of it as the platinum card for discerning spenders and travellers.

What Kind Of Benefits Are On Offer?

World-class travel perks

As part of the Ultra plan, you can enjoy free lounge access at more than 1,400 airports and ‘Cancel For Any Reason’ insurance – so regardless of the reason for cancellation, you’ll be refunded up to £5,000 per year for flights, trains, accommodation or events. You’ll also be covered for worldwide emergency medical and dental cover, including winter sports, as well as car-hire excess, lost or damaged baggage, delayed flights and personal liability (insurance T&Cs apply). Additionally, Ultra members that book accommodation with Revolut Stays (Revolut’s accommodation booking feature) will receive up to 10% cashback and enjoy unlimited foreign currency exchange in 30+ currencies, plus £2,000 worth of ATM withdrawals worldwide with no additional fees charged by Revolut.

Lifestyle subscriptions

A few of the perks included in the Ultra plan include a platinum-plated card, 24/7 member support with call-back service in English and access to subscriptions to organisations like the Financial Times, WeWork and ClassPass, to the value of £2,200 a year. In addition, you can enjoy £10,000 per year purchase protection, cancelled event protection of up to £1,000 and refund protection of £600+ on eligible purchases within 90 days of purchase. Finally, you’ll also unlock five full access accounts for Revolut <18, the account built for everyone aged 6-17 – so the kids can get involved, too.

Investing freedom

Ultra cardholders interested in investing will also be able to enjoy Revolut’s most generous limits yet, including lower crypto trading fees. Just bear in mind that investing exposes your capital to risk – especially in cryptocurrencies which are unregulated, not protected and can quickly lose value, and you may be taxed on gains.

How Do You Join Ultra?

Join the waitlist and Revolut will let you know as soon as Ultra is available for you. Once they do, you can sign up to the annual Ultra plan and get 5% cashback on purchases made in your first month, capped at the monthly plan price, T&CS apply.

Visit Revolut.com

*DISCLAIMER: The value displayed has been calculated based on the standalone financial value of new Ultra benefits (e.g. included partnerships), added with the value of savings made on charged fees for benefit usage (e.g. reduced remittances fees) in comparison to Standard plan fees. The latter is informed by the average use of each existing benefit by our top 10% of Metal customers during 2022. The overall value can be realised from using each plan benefit throughout a 1 year period. Please see the plan terms for a full plan benefit breakdown.

The trip and event cancellation insurance value is for illustration only based on the same customer sample as above, and their average annual spent on flights purchased with Revolut (£1,672.32) and bookings made through Revolut Stays (£1,340.30), equaling to £3,012.62 per year. A cancellation rate of 20.6% based on Revolut Stays data was applied and is the assumed factor for total trip cancellations (incl. flights). Value assumes all submitted claims qualify for 70% reimbursement. Please note this is an illustration only based on no product performance data being available to date. Maximum value will depend on user behaviour and can be derived up to the per claim and annual policy limit. Please refer to Insurance T&Cs for details and claims submission criteria.

Value of travel insurance is based on a standalone multi-trip, family travel insurance price provided by our insurance partner and not on usage.

Ultra T&Cs apply. See applicable plan fees in Revolut’s Fees Page. Redeemable cashback will be capped at the monthly plan price, and may be recovered in the case of an early downgrade. Cryptocurrencies are volatile and not regulated or protected by investor compensation schemes – value can go down or up. Trading may be subject to tax.

DISCLAIMER: We endeavour to always credit the correct original source of every image we use. If you think a credit may be incorrect, please contact us at info@sheerluxe.com.