The Money Saving App Everyone Should Have On Their Phone

CREATED IN PARTNERSHIP WITH HYPERJAR

First Of All, It’s Not A Bank Account

First things first – HyperJar is not another bank account. Instead, think of it like a virtual jam-jar budgeting app, which also comes with a dedicated debit card which you can use to purchase items online and in store. With zero subscription costs, fees or debt, you’ll never be pitched a loan or an overdraft. Instead, the app simply helps you plan ahead, rely less on credit, put more money away, grow your spending power, borrow and worry less. Plus, your credit score isn’t affected.

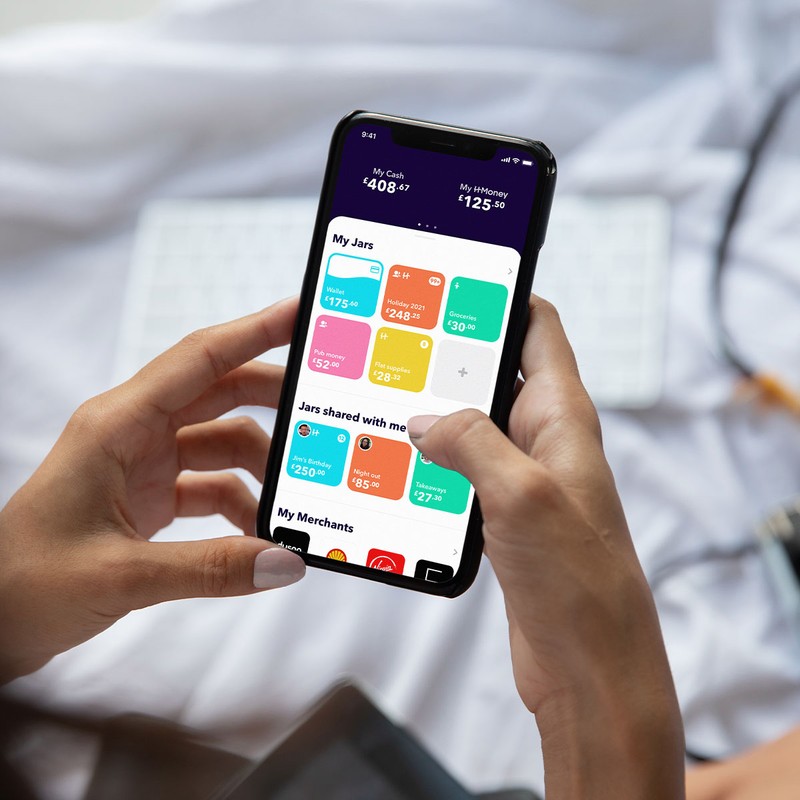

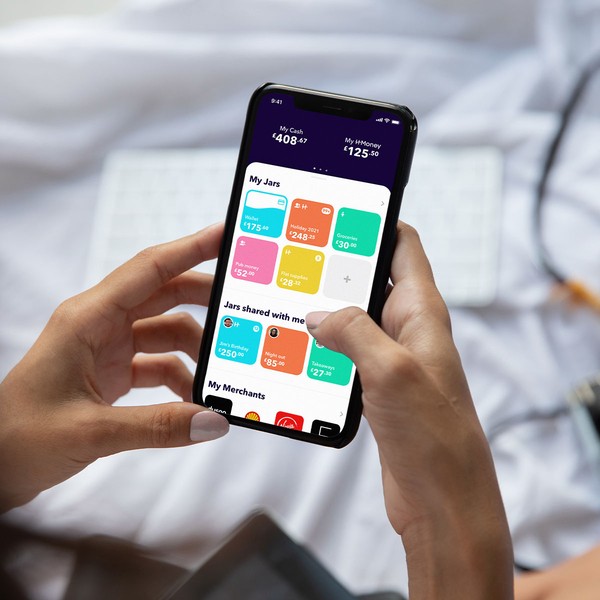

The Jar System Is Genius

As part of the app, the virtual ‘jars’ help you allocate and organise money for different expenses – whether it’s Christmas gifts for the family or saving up for a festive meal out. Either way, simply create your jar by giving it a name, a colour and set a budget target. You can then add money to it from your virtual wallet, and there’s even a function available to set up a shared jar, which is like a pop-up joint account. It’s useful for sharing bills with friends and family – and can be contributed to by up to 100 people (great for cumulative wedding or school expenses).

Transferring Money Couldn’t Be Easier

All you need to do to get saving is to transfer money from your normal bank into your HyperJar wallet – something you can do while you wait for your card to arrive. First, go to your main account screen and copy your HyperJar account number and sort code. Then, open your online banking site or banking app and use these details to make the transfer. Once you've done this once, it'll be quicker and easier next time.

You’ll Feel More Organised

When the time finally comes to start spending from your allocated jars, the good news is the money will have already been put aside, making you feel calmer and more prepared ahead of the big day, with none of the ‘impulse buying’ guilt so many of us fall victim to. Even better, you’ll get immediate notifications on all your spending, transfers and messages, as well as breakdowns of your spending patterns to help you stay on top of things throughout the festive season.

...And Far Less Guilty

You know that rush you get when you spend? But then the financial hangover kicks-in, and maybe a bit of regret after buying your fourth pair of identical white trainers? Well, some kind of feel-good magic happens when you organise your money with HyperJar. First, there’s just a warm glow from seeing your money clearly for the first time. Then comes the crystal-ball moment: with your finances this sorted, you can get on with planning some future fun with friends by sharing a jar – think a spa day, or a girls' trip to Mykonos next summer. We promise – your mental health is bound to benefit... Aaaaannnd breathe.

There Are Extra Treats On Offer

So we’ve almost saved the best news until last – in the Offers tab, you’ll find all of HyperJar’s merchant partners: shops, brands and businesses that are connected to the app. If you plan to spend with any of them in future, you can pay in advance in return for rewards. The app’s partnerships with FeelUnique, Blow Ltd and Boden offer 4.8% on advance funds – which means that if you allocate money to spend with them in future, you’ll earn the HyperJar version of interest – called the annual growth rate – of 4.8%. Perfect for a little January pick-me-up.

Real People Are Available To Help

Sick of internet chatbots trying to sort out your money issues? Not with HyperJar. The app’s customer service function is manned by real people, so there’s always a friendly human to help you out. Simply head to the main account screen and select the Live Chat function to speak to a real-life advisor. If the worst happens and you lose your phone or card, you can also access help via the main website to freeze your card or lock your account.

Finally, Rest Assured It’s Completely Safe

If you’re worried about how the app stores your personal data, don’t be. HyperJar uses bank grade 256-bit encryption to keep your data and money safe, and works with digital payment specialists like Modulr to protect and manage your money. Everything is deposited in segregated accounts, held directly by the Bank of England.

Visit HyperJar.com or download the app here.

*DISCLAIMER: Anything written by SheerLuxe is not intended to constitute financial advice. The views expressed in this article reflect the opinions of the individuals, not the company. Always consult with an independent financial advisor or expert before making an investment or personal finance decisions.

DISCLAIMER: We endeavour to always credit the correct original source of every image we use. If you think a credit may be incorrect, please contact us at info@sheerluxe.com.